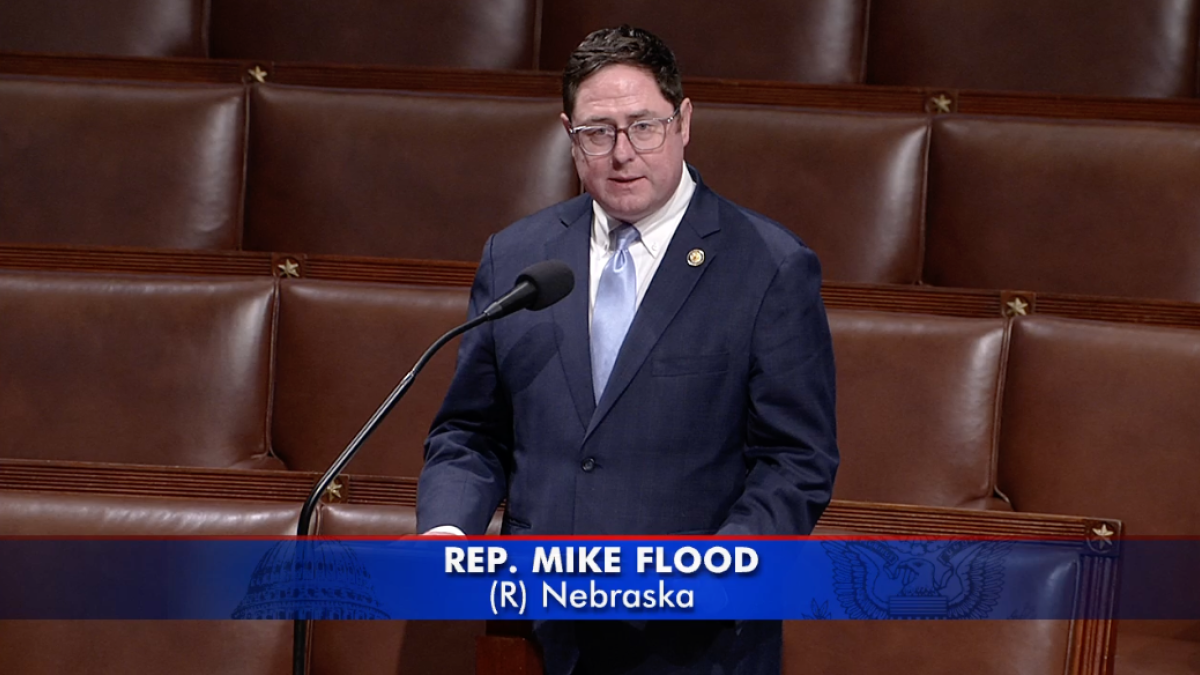

Congressman Flood Celebrates Passage of Measure Repealing Onerous Biden-Era Regulation on Payment Providers

WASHINGTON, D.C. – Today, U.S. Congressman Mike Flood issued a statement following passage of S.J. Res. 28 in the House. Using a process defined by the Congressional Review Act, S.J. Res. 28 overturns the CFPB rule relating to "Defining Larger Participants of a Market for General-Use Digital Consumer Payment Applications"

“Over the last four years, progressive activists sought to dramatically expand the regulatory authority of the Consumer Financial Protection Bureau,” said Congressman Flood. “One of the tools they used to achieve their goal was the Larger Participants Rule, which has attempted to leverage the agency’s examination authority to regulate non-bank consumer payments firms. Rolling back this regulation is critical to ensuring that the CFPB doesn’t become a barrier to innovation for job creators across America. Thank you to my colleagues in here in the House for their support of this CRA and to Senator Ricketts his leadership on this in the Senate. I look forward to President Trump signing this measure so we can quickly scrap another onerous Biden-era regulation.”

The U.S. Senate passed S.J. Res. 28 on March 5, 2025. President Trump is expected to sign the measure in the coming days.

During floor debate on S.J. Res. 28, Rep. Flood delivered remarks. Video of the remarks can be found here and the text as prepared for delivery is below.

Thank you (Mr./Madam) Speaker,

I want to thank Chairman Hill for his attentiveness to this issue, and I’d like to thank my Senate co-lead Pete Ricketts for championing this effort and getting the resolution through the U.S. Senate in less than a week—which is quite an achievement.

There’s lots of reasons to support this resolution eliminating the Larger Participant rulemaking from the CFPB:

- The CFPB finalized this rule in the eleventh hour in January of this year days before the transfer of power, well after other agencies stopped their rulemaking.

- The rule itself is effectively a regulatory power grab by the CFPB’s outgoing Biden nominee Rohit Chopra. By designating companies engaged in payments activities as Larger Participants, the Bureau will get to expand their examination authority over an amorphous and ill-defined group of firms with payments tools. Given their track record, I think it’s fair to say that we should not be supporting greater examination reach for the CFPB.

But I don’t want our concerns to remain abstract. Let’s take a look at some of the practical effects CFPB examination would have over these payment firms:

First, let’s take a look at some of the problems with how the rule actually distinguishes who is and is not a larger participant in payments. The rule does not only apply to tools where consumers are using wallets to exchange funds on a peer-to-peer basis, it also applies to any number of payment intermediaries that assist small businesses and merchants.

For example, express checkout tools would be affected by this rulemaking. Let’s say that you want to buy an item on the website of a small retailer in Lincoln, Nebraska. If that website allows interfacing with express checkout tools, and many do, then you’re going to see effects from this rulemaking on their ability to easily accept payments from their customers.

According to a survey from the Small Business and Entrepreneurship Council, 53% of small business owners use express checkout tools. When asked whether express checkout services help their business succeed, 94% of small businesses agreed that the online payment tool is boosting their business’s growth.

Yet, despite the obvious potential for main street and small business effects from this rulemaking, the CFPB failed to conduct any substantive analysis of the effects this rulemaking would have on small businesses, or even conduct a sufficient cost-benefit analysis of the rulemaking more broadly.

The reason? The Bureau was less interested in the costs of the rule than in expanding their own regulatory reach. This rule is a perfect example of the regulate first, ask questions later approach of the CFPB under Director Chopra. Ultimately, this style of regulation is going to chill innovation and hurt the smallest players that depend on these technologies to compete with the big guys.

I’d like to submit a letter for the record led by myself with 20 Financial Services Committee Republicans in 2023 highlighting this issue.

In addition, the Bureau has consistently tried to imply that their authority would not only apply to tech companies, but that there’s a chance they could bring merchants into their regulatory purview as well.

The General Counsel of the CFPB said in a speech during Director Chopra’s tenure that merchants might be implicated as large payment players in the future if they aren’t “mom and pops”.

Last year, in response to a Question for the Record from me on this topic, the Director made the case that a merchant “that incorporates payment capabilities directly into a website” could potentially blur the lines between banking and commerce and therefore be subject to CFPB oversight in the future.

Dodd-Frank explicitly calls for an exclusion for merchants from the CFPB’s regulatory purview. The idea that a merchant engaged in consumer financial activity due to payments activities in the merchant’s own store or website is ridiculous—and it represents yet another expansion of the CFPB’s rapidly growing authority.

Finally, I’d like to highlight another major concern CFPB examination authority of these firms would bring. The firms within the scope of this rulemaking are payments firms, but some of those firms also have a social media element to their business.

If we fail to act here in Congress, you will have career bureaucrats from the CFPB with the authority to examine some of the most influential social media companies in the country behind the scenes.

Do any of us really think that a liberal CFPB examiner would restrict their comments to only a social media company’s payment activities? Are we sure they wouldn’t provide some ‘feedback’ on the free speech policies of a Meta or an X?

Leaving this rulemaking in place could provide the next Democratic administration the tools they need to directly influence the companies that serve as intermediaries over the free speech debates that I know the people in this Chamber care about so deeply. That’s a recipe for disaster, and it’s something we should be taking really seriously while we still have the chance to fix it.

Passing this resolution is a way to pull back government bureaucracy, fight against overregulation and check the unaccountable CFPB. I strongly urge support for this resolution.

With that, I urge my colleagues to support this bill and I yield back.